Latest Updates:

visit Quantitative Finance section under 'Academics/Journals' to find latest content on Quant research.

visit Quantitative Finance section under 'Academics/Journals' to find latest content on Quant research.

Inspire Action

- Ask and you shall receive. Demand and you get nothing

Latest Links

Master reading for Quants & Financial Engineering Students.

http://www.quantnet.com/master-reading-list-for-quants

http://www.quantnet.com/master-reading-list-for-quants

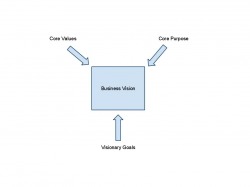

Business Vision

VISION: Setting plans or goals which a person or an organisation has to accomplish

MISSION: Putting vision into action is called Mission

Question of the day

Q: What is the difference between Investment Banking and Private Equity?

A: This question has to be answered in 2 parts; (i) from a valuation methodology perspective and (ii) from an agent vs. principal perspective. First, and most importantly, from a valuation (financial modeling) point of view, both Investment Banking and Private Equity are identical. This is due to the fact that the same traditional valuation methods are required for both practices, meaning that although the buyers (or sellers) change, their targets do not (i.e. whether an I-Bank or a PE Fund is doing the valuation on a target, the same methodologies will be used). This is why so many Private Equity professionals launch their careers at Investment Banks. In short, if you can effectively perform all the functions of an investment banker, you can transition those skills into private equity.

The second part of this answer has to do with the agent vs. principal investor role taken by each respective practice. This, of course, is where investment banking and private equity differ. Simply stated, the investment banker executes transactions (does deals) on behalf of his clients, whereas the private equity practitioner will execute transactions on behalf of his Fund (I-Bankers use their clients' money and assets, PE Firms use their own). Again, the valuation side is identical but the investor side is different. Most private equity firms will require a year or two of investment banking experience before hiring a professional. They are simply stricter when handling their own money than when handling their clients' funds.

A: This question has to be answered in 2 parts; (i) from a valuation methodology perspective and (ii) from an agent vs. principal perspective. First, and most importantly, from a valuation (financial modeling) point of view, both Investment Banking and Private Equity are identical. This is due to the fact that the same traditional valuation methods are required for both practices, meaning that although the buyers (or sellers) change, their targets do not (i.e. whether an I-Bank or a PE Fund is doing the valuation on a target, the same methodologies will be used). This is why so many Private Equity professionals launch their careers at Investment Banks. In short, if you can effectively perform all the functions of an investment banker, you can transition those skills into private equity.

The second part of this answer has to do with the agent vs. principal investor role taken by each respective practice. This, of course, is where investment banking and private equity differ. Simply stated, the investment banker executes transactions (does deals) on behalf of his clients, whereas the private equity practitioner will execute transactions on behalf of his Fund (I-Bankers use their clients' money and assets, PE Firms use their own). Again, the valuation side is identical but the investor side is different. Most private equity firms will require a year or two of investment banking experience before hiring a professional. They are simply stricter when handling their own money than when handling their clients' funds.